This year, we are holding public engagement on our budget for the first time. The aim of this is to receive input from the community to inform the final decisions which will be made on our budget in December and January.

In local government, the financial year runs from 1st April to 31st March. Our budget process starts in August each year when we begin to prepare estimates for our year end position and identify budget requirements based on the commitments in our strategic plan, planned activity and commitments. During September/October, each budgeting holding committee considers a draft budget and recommends it to our Finance Committee. This is the stage we are now at; each committee has agreed its draft and this engagement process is on these committee drafts.

In December, our Finance Committee will review the budgets and output from this engagement and agree recommendations to the January Full Council meeting which sets our budget and our precept (the amount we collect as part of council tax).

As part of this engagement process we are publishing:

- Draft Budget – this is a report from our finance system which compares the previous (2024/25) financial year with our spending and projected spending to date. It also includes our draft allocations for budgets in 2026/27.

- Budget Explained – which talks you through each part of our budget explaining what it is for, relevant information and key changes

- Band D Monthly Spend – this provides a summary overview of how the monthly amount we would collect in the council tax would be spent

OUR BUDGET 2026/27

The headlines of our draft 2026/27 budget are:

- Total budget expenditure of £1,121,082

- Total planned reserves of £474,334

- Precept (council tax) requirement of £877,630

- Band D council tax payment increase of £9.89 to £142.84 per year

BUDGET CONVERSATIONS

We held three budget conversation events, where we presented the budget and took questions from residents:

- 4th November at 7pm in Knutsford Market Hall

- 12th November at 1pm in Knutsford Market Hall

- 12th November at 7pm via Zoom

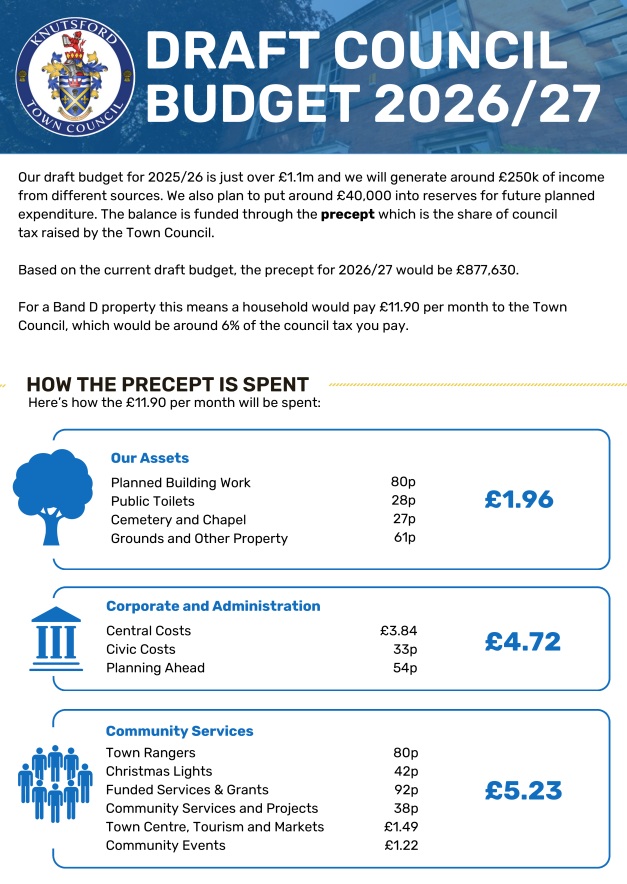

HOW THE £11.90 PER MONTH WOULD BE SPENT

OUR ASSETS

£1.96

This includes planned building work, the public toilets, our cemetery and chapel as well as other small properties/grounds we manage.

CENTRAL COSTS

£4.72

This includes civic costs, central staff costs and funds put into reserves for future planned expenditure.

COMMUNITY SERVICES

£5.23

This includes our town rangers service, community grants and projects, town centre, tourism and community events